By J C Suresh | IDN-InDepth NewsAnalysis

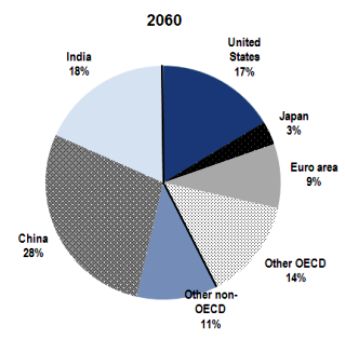

TORONTO (IDN) – Though the world is increasingly intertwined, the U.S. plays a unique role in the global economy, accounting for 11 percent of global trade and 20 percent of global manufacturing. The country’s global financial ties also run deep. Foreign banks hold about $5.5 trillion of U.S. assets, and U.S. banks hold $3 trillion of foreign assets.

While these interconnections have great benefits for the United States, they are not without risks, IMF Managing Director Christine Lagarde has warned, referring to the collapse of Lehman Brothers five years ago that ushered in “a harsh new reality” across sectors, countries, and the world.