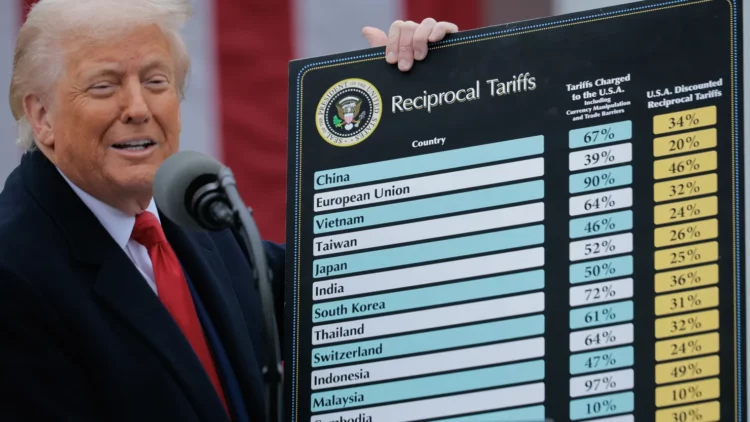

By Jayasri Priyalal* SINGAPORE | 2 June 2025 (IDN) — The unilateral declaration of reciprocal tariffs by U.S. President Donald Trump on trading partner countries has unfolded myriad uncertainties heightening the geopolitical and economic tensions. Immediate reactions were reflected in the global stock markets trading on negative levels. The full repercussions will be known in […]

Tackling global risks: how the financial sector can lead with impact

By Natalia Abril Bonilla and Lisa van den Hoven* AMSTERDAM | 12 May 2025 (IDN) — In 2025, it feels like we are in a period of declining optimism. As the recent World Economic Forum Global Risks Report set out, state-based armed conflict, extreme weather events, ‘fake news’ and falling trust – together with deepening […]

Cuts in Education, Health and Social Protection Trigger Rise in Economic Inequalities

By Rodney Reynolds NEW YORK | 21 October 2024 (IDN) — A new global index reveals that nine out of ten countries worldwide are pursuing policies that are likely to increase levels of economic inequality. Education and health cuts by nearly every country under World Bank and International Monetary Fund (IMF) programs are being described as “dispiriting, dangerous, […]

Up to 41 billion USD in World Bank Climate Finance Unaccounted for, Oxfam Finds

By Rodney Reynolds NEW YORK | 17 October 2024 (IDN) — Up to $41 billion in World Bank climate finance—nearly 40 percent of all climate funds disbursed by the Bank over the past seven years— is unaccounted for due to poor record-keeping practices, reveals a new Oxfam report published ahead of the World Bank and […]

Will the G20 Decide Minimum Tax on the Wealthiest of Our World?

By Sam Pizzigati* This article was originally published on Inequality.org , a project of the Institute for Policy Studies under a Creative Commons 3.0 License. NEW YORK | 4 August 2024 (IDN) — For the richest among us, life on Earth can sometimes get rather boring. But worry not for our world’s deepest pockets. At […]

Multilateral Development Banks Play Crucial Role in Financing Global Public Goods

By José Antonio Ocampo and Karla Daniela González, Columbia University This article was first published in the 2023/2024 UNDP Human Development Report – Breaking the Gridlock: Reimagining cooperation in a polarized world –on 13 March 2024. NEW YORK | 14 March 2024 (IDN) — There is broad-based agreement among the United Nations and the Group […]

China’s Asian Bank May Herald A New World Order

By Kalinga Seneviratne* | IDN-InDepth NewsAnalysis

SINGAPORE (IDN) – Since the 2008 economic meltdown, Europeans and the Americans have been asking the Chinese to contribute more to the Bretton Woods institutions. The Chinese, on the other hand, have been demanding reforms to the hegemonic system of management and voting rights in these institutions that favour the Americans and the Europeans. Both appeals have mainly landed on deaf ears.

EU Spares Trillions Hidden in Tax Havens

By R. Nstranis

IDN-InDepth NewsAnalysis

BERLIN (IDN) – ‘There is no alternative but to cut public spending and development aid’ has become a much repeated mantra for governments in the rich countries. But investigations reveal that there is a huge lot of hidden ‘private’ money that could put an end to extreme global poverty.

Is Time Ripe to Abandon the IMF?

By Raúl de Sagastizabal

IDN-InDepth NewsEssay

Hedging behaviour, a high degree of groupthink, intellectual capture, a general mind-set that excludes contrary views, fiefdom battles, inadequate analytical approaches, and lack of accountability should make governments ask themselves whether the time has not come to withdraw their support for the IMF.

The Sisyphean Task of Managing the Euro Zone

By Peter Wahl*

IDN-InDepth NewsAnalysis

BERLIN (IDN) – In spring 2011 it became more and more obvious that Greece would not be able to comply with the conditionality of the 2010 rescue package of €120 billion. Targets were not reached since the budget cuts and austerity measures had stalled growth, and the recession was deeper than calculated. Spending for unemployment went up while tax revenues fell.