Viewpoint by Khanyisa Mbalati

The writer was an Intern with the South Centre Tax Initiative.

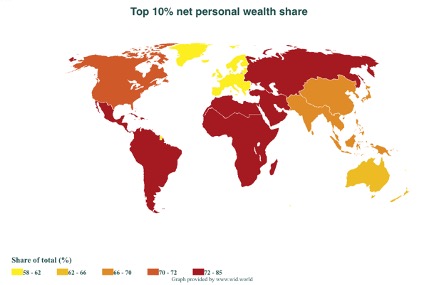

GENEVA. 24 July 2023 (IDN | SouthViews) — Sub-Saharan Africa is arguably one of the most unequal regions in the world, with high levels of income, gender and social inequality. The region is home to a large number of low-income countries. The map shows the top 10% of the population’s ownership of total wealth by region.

In Sub-Saharan Africa, a significant proportion of the population lives below the poverty line, with little access to basic services such as healthcare, education, and clean water. According to the World Bank, 389 million peoplein Sub-Saharan Africa were living in extreme poverty in 2018. This means they were living on less than $1.90 per day. Despite the region’s economic growth over the past two decades, inequality has remained persistent, with the poorest households often experiencing little to no improvement or a decline in their income. There is a large wealth gap between the rich and poor, with the wealthiest 10% of the population owning more than half of the region’s wealth.

A report by Oxfam International, in 2017, reports that the top 10% of the population in Sub-Saharan Africa owned 71% of the region’s wealth while the bottom 50% owned only 8%. This level of inequality is much higher than the global average.

High wealth inequality in the region

In Sub-Saharan Africa, a significant proportion of the population lives below the poverty line, with little access to basic services such as healthcare, education, and clean water. According to the World Bank, 389 million people in Sub-Saharan Africa were living in extreme poverty in 2018. This means they were living on less than $1.90 per day. Despite the region’s economic growth over the past two decades, inequality has remained persistent, with the poorest households often experiencing little to no improvement or a decline in their income. There is a large wealth gap between the rich and poor, with the wealthiest 10% of the population owning more than half of the region’s wealth.

A report by Oxfam International, in 2017, reports that the top 10% of the population in Sub-Saharan Africa owned 71% of the region’s wealth while the bottom 50% owned only 8%. This level of inequality is much higher than the global average.

Need for wealth taxes

One way governments can maximize the impact of tax policy on reducing inequality is by implementing progressive taxes, meaning that individuals with higher wealth and incomes pay a greater share in taxes. This can be achieved through a variety of mechanisms, such as implementing a progressive net wealth tax system, which taxes individuals with higher wealth at a higher rate.

Wealth tax is a form of taxation that is levied on an individual’s net worth, which includes assets such as real estate, investments, and personal property. There are no countries in the Sub-Saharan region with a wealth tax in place. The tax system is skewed towards consumption taxes, which can be regressive and place a heavy burden on low and middle income earners. Although none of the countries in the region have a wealth tax, it is possible that we see increased interest in this type of taxation as governments seek to generate revenue and reduce issues related to wealth inequality.

The effectiveness of a wealth tax depends on Its design and implementation, as well as the broader economic and political context in which it is implemented. A study conducted by Oxfam estimated that South Africa could raise up to ZAR 143 billion (approximately USD 9.4 billion) in revenue by implementing a 1% tax on the net worth of individuals with assets exceeding ZAR 1.5 billion (approximately USD 98 million).

Some countries have implemented such taxes successfully. One example is Argentina’s wealth tax.

Argentina has recently implemented a wealth tax as a way to raise revenue and combat inequality. A one-time special tax known as the “millionaire’s tax” was enacted by debt-ridden Argentina in December 2020, and it has so far raised about $2.4 billion to fund pandemic recovery. Under the wealth tax policy, individuals with net assets of more than 200 million pesos (around $2.5 million) will be subject to a one-time tax of up to 3.5% on their wealth. The tax rate increases for individuals with assets abroad, with a maximum rate of 5.25% for those with assets exceeding 3 billion pesos (around $3.7 million).

Potential wealth tax rates for Sub-Saharan Africa

A high wealth tax rate is appropriate in countries with high levels of inequality and limited tax revenue like in Sub-Saharan countries. With a high tax evasion rate, the region needs a high rate to collect as much revenue as it can. The Pandora Papers have revealed that an estimated $8 trillion of personal financial wealth is in offshore accounts, $500 billion of which is held by Africans. Along with non-financial offshore assets like property and artwork, this translates to the region losing tax revenue which reduces the funds available, inter alia, for investment in critical infrastructure and public services, such as health care and education.

Strategies to combat tax evasion include improving tax administration and enforcement, increasing transparency and information exchange between countries, and penalizing the use of tax havens and other illicit financial activities. A comprehensive approach that combines multiple strategies is likely to be most effective in combatting tax evasion.

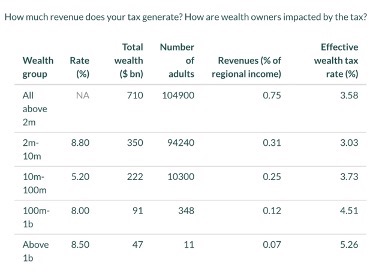

Higher tax rates on the wealthy are recommended given the high inequality in the region and to ensure adequate revenue over the costs of administering the tax. Figure 4, for instance, applies Argentina’s rates to Sub-Saharan Africa using the World Inequality Database’s wealth tax simulator to generate potential revenue estimates with an assumed 30% evasion rate and a 10% depreciation rate.

As can be seen in chart below, the effective rate tends to be lower than the statutory rate Thus, for an effective tax rate of 3-5%, the Sub-Saharan region would have to implement a tax rate starting from 8.8% on net wealth of $2 million, 5.2% on net wealth above $2-10 million, 8% on net wealth above $10-100 million and 8.5% on net wealth on $1 billion and above. This means that the number of taxpayers will range from 94,240 people with wealth from $2-10 million who will pay an effective tax rate of 3.03% to 11 people with a net wealth of $1 billion and more who will pay 5.25% tax each on their wealth.

The United Nations estimates a funding gap of USD 200 billion per year to be filled if African countries are to meet the Sustainable Development Goals’ (SDGs) targets by 2030.

A wealth tax is needed in Sub-Saharan Africa. By increasing transparency on the assets held by wealthy individuals and implementing a wealth tax, African countries can take a significant step towards mobilising resources for development and promoting greater economic and social equality.

Note: This article is published as part of an exchange agreement with the South Centre, which is an intergovernmental organization composed of and accountable to developing country Member States. It was established on July 31, 1995 with headquarters in Geneva, Switzerland. It has 54 member countries. [IDN-InDepthNews]

Image source: Pambazuka News

IDN is the flagship agency of the Non-profit International Press Syndicate.

We believe in the free flow of information. Republish our articles for free, online or in print, under Creative Commons Attribution 4.0 International, except for articles that are republished with permission.