By Jayasri Priyalal*

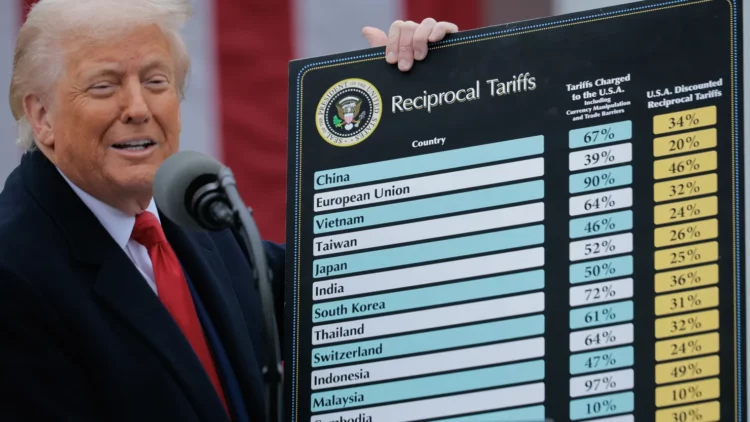

SINGAPORE | 2 June 2025 (IDN) — The unilateral declaration of reciprocal tariffs by U.S. President Donald Trump on trading partner countries has unfolded myriad uncertainties heightening the geopolitical and economic tensions. Immediate reactions were reflected in the global stock markets trading on negative levels. The full repercussions will be known in a couple of years. The International Money Fund (IMF) has forecasted a downward economic growth for the United States.

Professor Jeffrey Sachs, economist and Director of the Centre for Sustainable Development at Columbia University, has been critical of President Trump’s decision. He argues that amid this turmoil, a small group of billionaires who are close to the Trump administration would have made a killing.

The erratic market fluctuations present real opportunities for those who aspire for state and regulatory capture in the current context. They cash in on the pain and losses of millions, often recovering the money spent on election campaigns by leveraging information asymmetry. For them, capitalizing on crisis is simply business as usual.

The long-held belief that ownership societies would prosper through the trickle-down effects of wealth has proven illusory. Blind faith in the neo-liberal order has failed to deliver meaningful progress for billions of people struggling to achieve upward mobility and a better quality of life. Instead, decades of market-driven, neo-liberal policies have exacerbated inequality in income, wealth, education, and healthcare, both in advanced economies and in the developing countries.

In a report published in January 2025, Oxfam noted that over the past year, total billionaire wealth increased by $2 trillion, with 204 new billionaires added, an average of almost four per week. Meanwhile, the number of people living in poverty has remained stagnant, dramatically widening the global wealth gap.

In many democracies, this growing sense of hopelessness has led voters to elect extreme right- or left-wing populist governments in search of alternative policy solutions. For many citizens, hope becomes the only antidote to fear. However, those who attain power often lack original ideas or effective policy alternatives to stimulate growth in economies burned by debt, such as the United States. Instead, they frequently fall back on outdated and ineffective economic strategies to maintain political survival.

China Daily reported in a front-page article on May 29 that credit rating agency Moody’s has downgraded the U.S. credit rating from top-tier Aaa to Aa1—for the first time in over a century—over concerns about the nation’s growing debts, now exceeding 120% of its annual economic output.

In these uncertain times, elections are increasingly won through the manipulation of public perception and the strategic use of misinformation. Social media platforms have become powerful tools for shaping narratives, offering templates to manufacture hope, mislead the public, and normalize populist ideologies. These tactics often divide societies by blaming elites, or external actors, for the public’s hardship, which is more often rooted in past policy failures. While some politicians exploit these dynamics for electoral gain, retaining public trust and delivering on campaign promises remains a significant challenge once in office.

Trade Deficits Caused by Weakened Productivity in the Real Economy

Taxes and tariffs remain key revenue sources for governments managing national economies. However, over the past decades, a persistent there mismatch between state revenues and expenditures has emerged. Instead of stimulating growth through increased productivity, consumption was encouraged through higher debt levels, which have grown disproportionately in both developed and developing countries.

This trend has deepened inequality and channeled cheap money into high-risk corporate ventures, where earning quick returns through speculation, now widely referred to as “Casino Capitalism.” As a result, government revenues have become overly reliant on consumption taxes.

Under the neo-liberal economic model, large-scale tax concessions were granted to corporations, while tax havens were set up to hide wealth created in formal economies. Consequently, consumption taxes and tariffs have become primary revenue sources, further driving up the cost of living for the average citizen.

On May 25, Fareed Zakaria, in his CNN program “The War on Government,” revealed that tax concessions granted to high-net-worth individuals under Presidents George W. Bush and Donal Trump totaled approximately US$10 trillion, equivalent to 57% of the U.S. debt-to-GDP ratio.

The total value of tradable financial assets in global markets is estimated at US$271 trillion. Of this, fixed income securities, primarily debt instruments, make up approximately US$116 trillion, or around 54%. According to analysis from Ocorion, private assets have grown nearly three times faster than public assets over the past 15 years.

This imbalance is a core driver of economic inequality. As private wealth multiplies rapidly, billions of marginalized individuals are left behind, trapped in a cycle of economic insecurity. This widening gap fuels frustration and disillusionment, providing fertile ground for the rise of populist politics around the world.

The Three “D” Threats and Dangerous Trends

Deplorable Debt, Degraded Environment, and Depleted Natural Resources are the three “D” problems threatening the sustainability and habitable coexistence of humankind. The illusion of prosperity over the past few decades was only possible through exploitation within an unsustainable linear economic model, leading to these highlighted 3D problems.

Among these threats, Deplorable Debt is particularly alarming in the context of the U.S. economy. President Trump’s economic strategies, including tariff hikes, are partly aimed at reducing demand U.S. dollars abroad, assuming that a weaker currency will ease the burden of debt.

Yet, the U.S. dollar’s role as the world’s dominant reserve currency has sustained high international demand. Those holding US dollar-denominated assets booked fictitious profits by applying market revaluation principles. Meanwhile, oligopolistic American credit card companies have fueled overconsumption by promoting debts expansion, without creating the credit necessary to support productive investment in the real economy.

Global credit card giants thrive on the resulting cash flows, while central banks and monetary authorities are left to control inflation at negative or near zero interest rates. Some credit cards even levy punitive interest rates of up to 28%. This distorted system causes private debt to morph into public debt, eventually contributing to unsustainable levels of sovereign debt. Excessive financialization, particularly through consumer and corporate debt, now threatens to destabilize the global financial system established after World War II.

“The dollar is our currency, but it’s your problem” John Connally – 1971

There have been two key moments in modern history when the U.S. dollar was deemed overvalued, prompting presidential intervention to reduce its strength.

In 1971, President Richard Nixon introduced the Smithsonian Agreement, which he called the most significant monetary agreement in the history of the world. Later, in September 1985, President Ronald Reagan signed the Plaza Accord, a deal among five major economies to depreciate the U.S. dollar in response to trade imbalances.

However, neither agreement had long-lasting effects. As Professor Harold James of Princeton University notes, Nixon’s Treasury Secreaty, John Connally, famously told European leaders: “The dollar is our currency, but it’s your problem.” That sentiment still resonates today. Despite five decades of policy shifts, the burden of a strong U.S. dollar continues to ripple through the global economy.

President Donald Trump appears to face a similar challenge. Believing that the dollar remains overvalued and that American exporters and workers are at a disadvantage, Trump has introduced reciprocal tariff measures. Though not officially named, this evolving set of policies is already being referred to as the “Mar-a-Lago Accord.”

* Jayasri Priyalal is the Finance Director of UNI Global Union Asia and Pacific.