NEW YORK (IDN | GIN) – Canada has joined the IMF, World Bank and several other countries in cutting aid to Mozambique over concerns about the country’s finances.

CTV News reported on May 9 that Mozambique had more than $1.3 billion in undeclared debts, which raised concerns among donors over its financial management. Fourteen donor agencies and countries, including the U.K., Portugal and Switzerland, are freezing a portion of their development assistance.

Canada’s high commissioner in Mozambique said on Twitter on May 9 that general budget support has been frozen – that’s aid that goes directly to Mozambique’s government. Development assistance provided to NGOs and multilateral organizations like the UN remains in place.

In the midst of freezing aid, banks that saw dollar signs in the developing economies of Africa are being blamed for a looming fiscal crash in Mozambique over so-called “tuna bonds”.

Emblematic of the easy lending by western banks, 24 fishing boats meant to be a modern tuna fleet are gathering rust in the port of Maputo.

The boats were paid for out of an $850-million loan arranged in 2013 by Credit Suisse and Russia’s VTB to finance “fishing infrastructure”.

Instead of creating jobs, raking in hard currency and providing a cheap source of protein in this low-wage country, they represent billions in loans to be repaid no matter the social costs.

The price of basics such as bread and fuel are already rising along with public anger at the scale of the problem. Armed soldiers and police took to the streets of Maputo last week after rumours of demonstrations.

Not only did the state tuna-fishing company fall short of its targets but $500 million of the “tuna bond” was used improperly for maritime security – defence spending not authorized by the parliament.

Revelations of the hidden spending has led the International Monetary Fund to suspend bailout loans, which were helping Mozambique pay its $12 billion debt to external lenders.

Meanwhile, the UK-based Jubilee Debt Campaign, which coined the phrase “iceberg of debt”, has called on the banks to “pay the price for these illegitimate loans.” They denounced the banks for their uncritical lending at a time when interest rates in the developed world were ultra-low and banks sitting on billions of dollars were looking elsewhere for high yields.

“Both lenders and borrowers are responsible for ensuring loans are given and used responsibly,” said Tim Jones, a policy officer of the Campaign.

“Credit Suisse and VTB should pay the price for these illegitimate loans, and should not be bailed out indirectly by the IMF or anyone else.”

The Ivorian chief executive of Credit Suisse, coincidentally, was quoted by the Wall Street Journal as saying in October 2015 that it was “madness” for poor countries to finance infrastructure through dollar borrowing, declined to comment.

The southern African country now must repay over $12 billion or 82 percent of the GDP.

“We see the government lied to us and things will get harder for ordinary Mozambicans now,” 37-year-old singer Tinoka Zimba said. “We used to think that we are all in together, trying to make things better. This crisis is really sad.” [IDN | INPS – 9 May 2016]

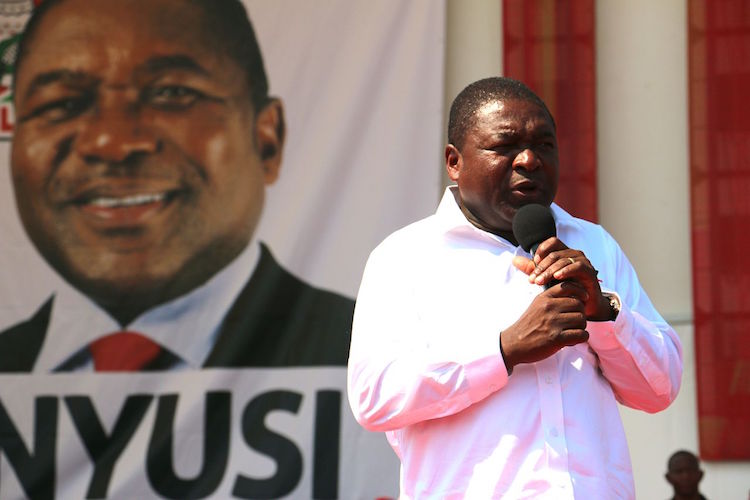

Photo: Incumbent President Filipe Nyusi at his campaign rally in Maputo in 2014. Credit: Adrien Barbier | Wikimedia Commons

IDN is flagship of the International Press Syndicate.