By Alex Helan

The writer is a Senior Researcher at Rainforest Action Network.

LONDON | 4 May 2025 (IDN) — Trade shocks and geopolitical restructuring likely mean economic instability is the new norm and will be compounded by climate and natural shocks like the fires in Indonesia, Brazil and the United States. Banks’ role in managing these systemic risks must face greater scrutiny.

In 2021, Japan’s largest bank, Mitsubishi UFJ Financial Group (MUFG committed to carbon neutrality by 2050 and adopted a policy requiring its clients to commit to ending deforestation and the destruction of peatlands – the world’s largest terrestrial store of carbon and crucial ecosystems for managing freshwater.

However, analysis from the Forests & Finance Coalition shows that from 2020-2023, MUFG, through its Indonesian banking subsidiary Bank Danamon, provided over $280 million in credit to Tunas Baru Lampung (TBLA), an oil palm and sugarcane company actively engaged in draining and converting vast areas of peatlands into plantations in Indonesia.

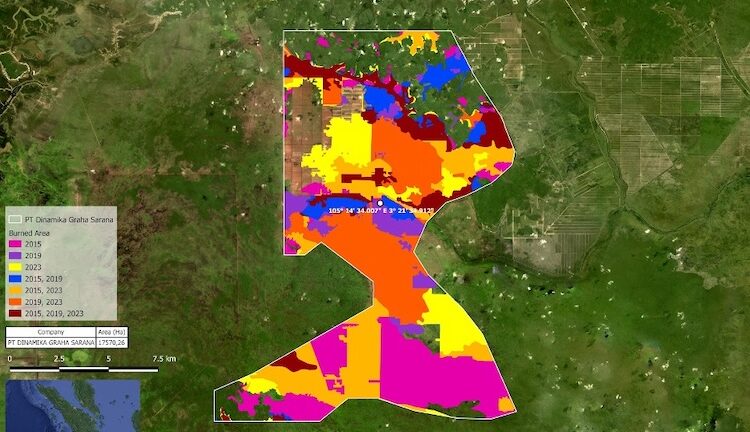

Our investigations using satellite imagery and on-the-ground investigations show that TBLA was responsible for destroying around 7,800 hectares of peatlands during this period, an area 1.3 times the size of Manhattan Island.

Indonesia’s peatlands are swampy, fire-resistant carbon sinks in their natural state. When drained for cultivation, they dry out and become major sources of greenhouse gas emissions. Degraded peatlands also become flammable and burn during dry seasons, causing toxic smoke to spread across Indonesia and neighbouring countries, precipitating regional public health crises and billions in economic losses and damage.

The environmental fallout from TBLA’s peatland expansion – financed by MUFG – was predictable and devastating. In the dry season 2023, over 14,500 hectares — roughly 20,000 football fields — of land inside TBLA concessions were engulfed in fires, unleashing toxic haze, endangering lives, and accelerating climate change.

One TBLA-controlled company is now facing a $42 million civil lawsuit from the Indonesian Ministry of Environment and Forestry for alleged environmental and economic damages related to these fires. RAN presented our findings to TBLA but received no response.

Weak Oversight

This case represents more than a lapse in judgment. It highlights serious weaknesses in MUFG’s approach to client due diligence and international implementation of its policies. The bank’s ‘No Deforestation, No Peatland, No Exploitation’ (NDPE) policy means very little, if not implemented, in countries like Indonesia, where tropical forests and peatlands continue to be destroyed.

The most basic level of due diligence on TBLA would have revealed a company that’s clearly in conflict with MUFG’s environmental commitments. It had no public NDPE commitment and had been continually converting peatlands for years. It had received multiple sanctions for fires in its concessions and had resigned from the Roundtable on Sustainable Palm Oil (RSPO) certification body in 2020.

Approximately 80% of global palm oil refiners now implement NDPE standards across their operations, prohibiting new peatland development. TBLA does not, and it has been on the ‘no buy’ list of several palm oil traders since 2018. MUFG’s continued financing of TBLA not only places MUFG behind its bank peers but undermines efforts to reform the palm oil sector. TBLA continues to be a client of Bank Danamon — and, by extension, MUFG — with outstanding loans through 2026.

MUFG informed RAN that Bank Danamon sets policies incorporating MUFG’s environmental and social policies as much as possible. However, it is not precisely the same because the situations towards decarbonization differ by region and country.

MUFG at a Strategic Crossroads

A report by Forests & Finance estimates that MUFG has provided $6.6 billion in forest-risk commodity finance since the Paris Agreement, including $2.4 billion to Southeast Asia’s palm oil sector. MUFG’s actions have global ramifications. MUFG has pledged to reach net-zero emissions by 2050 and build a business that protects natural capital.

But how can investors, governments, or the public take these claims seriously when they breach their commitments?

Ahead of its June Annual General Meeting in Tokyo, MUFG has an opportunity to demonstrate that it takes environmental risk seriously — not only as a matter of public perception, but of fiduciary duty and operational integrity. It should close the loopholes that exist in its policies and demonstrate how it will implement its commitments. [IDN-InDepthNews]

Image source: Rainforest Action Network