By Erfan Ghassempour, Hamidreza Ghanei Bafghi, Abdollah Ale Ja’far and Samira Fatemi

IDN-InDepth NewsAnalysis

TEHRAN (IDN) – India and Iran have had economic relations for centuries. However, their relations entered into a new era after the partition of the Indian subcontinent into India and Pakistan, the Iranian Islamic republic revolution and the Iranian nuclear issue.

Following the partition of the Indian subcontinent, India lost its adjacency with Iran and the two countries followed divergent foreign policies arising out of the post-partition political developments ([i]). On the other hand, Iranian Islamic revolution changed Iran’s relation with the world including India. In the recent years and after the international sanctions against Iran’s economy, Iran and India are experiencing a new and complicated political and commercial relationship. Read in Persian

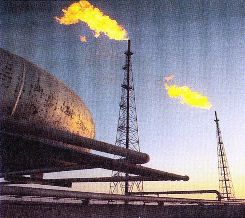

India-Iran commercial ties are mostly related to Indian import of Iranian crude oil. On one hand, India is the second largest buyer of Iranian crude oil. On the other, Iran is the sixth biggest supplier of crude oil to India ([ii]). Iran is also a major source for India’s imports of petrochemical substances.

Even after the sanctions imposed on Iranian crude exports, India and Iran have put in place a rupee payment mechanism for continuing oil trade, because foreign banks had refused to deal with Iran fearing penalties by the US.

India and Iran hold regular bilateral talks on economic and trade issues at the India-Iran Joint Commission Meeting (JCM) ([iii]). Recently, in the JCM, the opportunities for India to participate in various projects in Iran including in oil and gas sector is discussed ([iv]).

The two countries have held talks on various projects, including the IPI gas pipeline project, A long term annual supply of 5 million tons of LNG, development of the Farsi oil and gas blocks, South Pars gas field and LNG project, Chahbahar port project (Chabahar port is often referred to as the ‘Golden Gate’ to the landlocked Commonwealth of Independent States (CIS) countries and Afghanistan).

The two countries have also signed a Bilateral Investment Promotion & Protection Agreement (BIPPA) and are in the process of finalizing a Double Taxation Avoidance Agreement (DTAA).

Indian companies which had or have a presence in Iran include ESSAR, ONGC Videsh Ltd. (OVL) and TATA. Joint ventures between India and Iran include the Irano-Hind Shipping Company, the Madras Fertilizer Company and the Chennai Refinery.

Benefits for Iran

According to the OPEC Annual Statistical Bulletin published on 2013, Iran has 157.30 billion barrels of proven oil reserves and 33,780 trillion cubic meters of proven gas reserves ([v]). It ranks third in the world in oil reserves and second in gas reserves ([vi]).

Iran’s economy is heavily reliant on oil and gas as its main source of foreign currency earnings. In fact, Iran’s hydrocarbon sector is the main pillar of the country’s economy. Revenues from oil and gas exports account for about 42.5% of government revenues and are Iran’s chief source of foreign exchange ([vii]).

But the lack of foreign investment had already dragged down production of oil and gas in Iran. The foreign investment which results in transfer of technology and funds is an important element for the development of hydrocarbon sector which Iran lacked in the recent years.

Meanwhile Iran needs to increase its production and its position in the OPEC and to play a chief role in the petroleum market.

Iran shares several joint oil fields with its neighbors. Iraq, Qatar, United Arab Emirates and Iran’s other neighbors by entering in to contracts with powerful oil companies have increased their production in their joint oil fields with Iran. But due to the international sanctions, Iran is not able to cooperate with those companies to develop its joint fields.

Therefore and since Indian companies have the technology and funds, Iran needs Indian investment in its hydrocarbon sector to increase the amount of oil and gas production. In fact, the Indian’s investment in Iran’s oil sector would have the following main results for Iran:

– Transfer of technology and funds;

– Increase of oil and gas production;

– Improvement of economy;

– Decrease of unemployment level;

– Improvement of Iran’s prestige in the global community.

– Improve Iran’s position in OPEC

Benefits for India

In today’s world, the high ratio of the energy consumption reflects the development of countries and those without enough energy resources face many economic and political difficulties and have to prepare their required energy at any costs.

Because of its large population and the need for fast economic growth, India’s share in world energy demand is projected to increase from 5.5% in 2009 to 8.6% in 2035 ([viii]).

With high rates of economic growth and over 17 per cent of the world’s population, India has become a significant consumer of energy resources. The government hopes to maintain an annual gross domestic product (GDP) growth rate of about 8–10 per cent over the next quarter century to meet its goals for poverty eradication. This level of growth will require India to at least triple its primary energy supply.

The Indian refinery possessed the capacity of 177 million metric tons by 2012. Therefore, India is getting to be a regional refinery center, so India needs safe and secure imports. It seems Iran is one of the best choices of India due to its geographical situation.

Although India’s natural gas production has consistently increased, demand has already exceeded supply and the country has been a net importer of natural gas since 2004. Iran has an enormous reserve of natural gas, which according to a 2008 estimate stands second only to Russia.

Already India imports more than two-thirds of its hydrocarbon requirements and any further escalation would adversely affect its energy security ([ix]).

Therefore India has to diversify its manner of energy supply. It seems that investing in other countries to explore and exploit their oil fields is the best way to supply more petroleum to India. Iran is close to India geographically and has good political ties with it. Furthermore the two countries have many cultural affinities that facilitate the India’s investment in Iran.

Yet, India has expressed its determination to continue to pursue its energy cooperation with Tehran ([x]). ,

View to the Future

After the Geneva agreement between Iran and P5+1 (UN Security Council permanent members Britain, France, Russia, USA and China as well as Germany), experts are so optimistic about the lifting of sanctions against Iranian oil and gas industry. Now many companies are waiting for the green light from the sanction-imposers to invest in Iran’s vast oil and gas fields.

According to Reuters, on December 4, the Iranian Oil Minister Bijan Namdar Zanegeneh named seven western oil companies which Iran wants back to Iran’s oil and gas sector which is a bright sign to oil companies.

After the lifting of sanctions, Indian companies by establishing joint-ventures, consortiums and other kinds of co-operations with those oil giants or even independently can participate in Iran’s oil and gas industry and increase the energy security for their country.

Iran can benefit itself from Indian’s companies’ participation in its hydrocarbon sector to promote its relation with India and increase its crude production. *Erfan Ghassempour is doing Masters in International Law at the Allameh Tabatabai University, Tehran, with focus on ‘Indirect Expropriation in the International Oil and Gas Arbitration’. As Bachelor in Law he wrote thesis on ‘The Role of United Nations on Prevention of Wars’. [IDN-InDepthNews – December 24, 2013]

Picture credit: Wikimedia Commons

2013 IDN-InDepthNews | Analysis That Matters

Send your comment | Subscribe to IDN newsletter

Follow us on Twitter and Facebook:

http://twitter.com/InDepthNews

http://www.facebook.com/IDN.GoingDeeper

[i] K.N. Tennyson, “India-Iran Relations: Challenges Ahead”, Air Power Journal, Vol. 7, No. 2, Summer 2012 (April-June).

[ii] Meena Singh Roy, “India and Iran Relations: Sustaining the Momentum”, Institute for Defence Studies and Analyses, May 20, 2013.

[iii] “Iran-India Economic Ties”, at http://www.iran-embassy.org.in/page.php?m1id=38&clid=38.

[iv] Joint Press Statement on 17th India-Iran Joint Commission Meeting, May 4, 2013, at http://www.mea.gov.in/press-releases.htm?dtl/21652/Joint+Press+Statement+on+17th+IndiaIran+Joint+Commission+Meeting

[v] OPEC Annual Statistical Bulletin, 2013, at http://www.opec.org/opec_web/static_files_project/media/downloads/publications/ASB2013.pdf.

[vi] “Iran Implementing South Pars Projects”, December 25, 2010, at http://www.presstv.com/detail/156997.html, accessed January 12, 2012.

[vii] “Iran Overview”, at http://www.worldbank.org/en/country/iran/overview.

[viii] Sun-Joo Ahn and Dagmar Graczyk, “Understanding Energy Challenges in India” , at https://www.iea.org/publications/freepublications/publication/India_study_FINAL_WEB.pdf.

[ix] Sujata Ashwarya Cheema, “India-Iran Relations: Progress, Challenges and Prospects”, India Quarterly: A Journal of International Affairs 2010 66: 383, at http://iqq.sagepub.com/content/66/4/383.full.pdf.

[x] “India Snubs US Sanctions on Iran”, The Times of India, June 1, 2012, at http://articles.timesofindia.indiatimes.com/2012-06-01/india/31957838_1_india-snubs-legitimate-trade-interests-nuclear-issue.