By Robert Johnson

BRUSSELS (IDN) – A spectre is haunting Europe – the spectre of Growing Economic Divides, which threaten to create tensions not only between the young and the old but also between employers and employees as well as between the low- and high-income earners. At the heart of the growing divides is housing, and these often play out across regions within countries, says a new World Bank report. High-productivity jobs are concentrated in metropolitan regions where housing prices are inflated and rents are high.

“Housing in European metropolitan areas has become unaffordable for many because new construction is not keeping up with demand,” affirms Gabriela Inchauste, Lead Economist for Poverty and Equity at the World Bank and co-author of the report.

“Since a large portion of the housing stock is owned by older generations, this shuts out younger generations, who cannot afford to live in the most productive locations with the highest employment opportunities, such as capital cities,” she adds.

In Living and Leaving: Housing, Mobility and Welfare in the European Union, the World Bank analyses how the affordability of housing impacts labour productivity, growth and opportunities for citizens in the EU’s 28-member states. Those living in 26 of the 28 EU capitals say that finding good housing at reasonable prices is not easy.

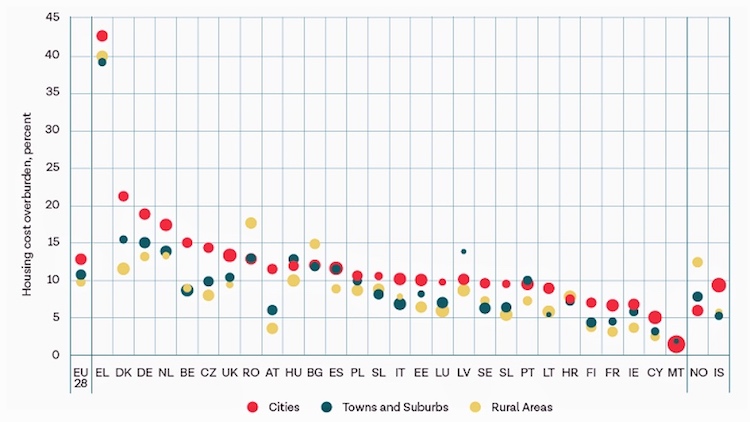

The report finds that Greece, Bulgaria, Denmark, Germany, Romania and the United Kingdom are the countries where families are the most overburdened by the cost of housing, while those in Malta, Cyprus, Finland, Ireland, Estonia and France are best off within the EU.

In a press release issued on November 8 in Brussels, Arup Banerji, World Bank Regional Director for the European Union says: “Housing is now considered the most important national issue in many EU countries. It is at the heart of growing economic divides in Europe and people are getting anxious.”

With the right policy framework to ensure that residential construction increases when house prices rise, EU countries can help young people access affordable housing, which will have positive knock-on effects for social mobility and productivity, adds Banerji.

Building on earlier works, including Growing United, the report identifies the intergenerational inequality created by the shortage of new housing. It highlights that tax and spend policies across the EU have focused primarily on home ownership, which has greater benefits for older generations.

“By contrast, few resources have been devoted to programs that would increase housing development and reduce the costs for tenants, which would help younger age groups,” avers the World Bank report.

The report calls for “recalibration” of the EU housing policy to avert a housing crisis in metropolitan areas, and highlights three key recommendations for EU policymakers: earmark unused public land for housing development and speed up approval processes; invest in greenfield projects with improved transportation links from suburban areas, to ensure cities cast a wider economic net; and create public registries to improve transparency of house sale prices to help greater competition between areas.

The significance of the World Bank report is underlined by the fact that the European Union has stood out as the region with the fastest convergence of living standards over the past four decades. The EU accelerated the development of poorer countries through its enlargement, the single market, and structural and investment funds. Trade and financing generated convergence in living standards between member states.

This, together with a strong enterprise sector and innovation, drove Europe to account for about one-third of world gross domestic product (GDP) with less than one-tenth of the world’s population.

Through the accession process, convergence was particularly powerful for the EU’s newest members. Despite the global financial crisis, Romania’s GDP per capita increased from 35 percent of the EU average in 2005 to 58 percent in 2016, while Poland became a high-income country faster than any other country in the world except the Republic of Korea.

However, Europe is now seeing growing divides also as a result of widening productivity gaps between firms and growing inequality in labor incomes. Household income inequality has been on the rise in many parts of the EU since the 1990s, as real earnings of the poorest 10 percent of workers have declined.

The impact of recession has been visible in communities, but the hardship has not fallen equally on all shoulders. Income inequality is gradually increasing in several EU countries as low-income people fall behind while capital income and wealth are increasingly more concentrated at the top of the distribution.

Europe’s jobs increasingly emphasize nonroutine, cognitive tasks that are complementary to what machines can do, notes the report. As such, high-skilled workers see their incomes rise while low-skilled workers lose out as manual jobs become scarcer. notes the report.

At the same time, although Europe’s frontier firms are among the global elite, its lagging firms increasingly fall behind global competitors. “This growing divide has a spatial dimension: living standards have diverged across regions within countries, driven by the coexistence of thriving locations with a high concentration of high-skilled workers and frontier firms alongside other places that languish,” declares the report. [IDN-InDepthNews – 10 November 2018]

Graphic: Housing affordability is most problematic in EU cities. Credit: World Bank

IDN is flagship agency of the International Press Syndicate.

facebook.com/IDN.GoingDeeper – twitter.com/InDepthNews