By Kester Kenn Klomegah

MOSCOW | 12 September 2025 (IDN) — When Donald Trump returned to the White House earlier this year, observers braced for another bout of upheaval in U.S. foreign policy. But what’s unfolding isn’t merely a rerun of his first term. This time around, Trump is deploying geoeconomics—strategic use of economic tools—as a primary lever of influence. The effects are rippling far beyond Washington, and perhaps nowhere more than in Africa, a continent simultaneously sidelined and unexpectedly empowered by the shifting global order.

To unpack these dynamics, I spoke with Pradeep Mehta, Secretary General of Consumer Unity and Trust Society (CUTS International), a policy think tank based in Jaipur, India. Mehta, who advises India’s Commerce and Industries Minister, believes Trump’s approach is guided less by strategy and more by instinct. Yet its implications for Africa are both significant and enduring.

The “Middle Kingdom” Mindset

“Trump’s policies don’t consist of a coherent underlying ideology,” Mehta said. “What we are seeing is an American iteration of far-right national populism.”

This populism—sceptical of multilateralism and obsessed with sovereignty—is not new. It has surfaced in Europe, Latin America, and Asia over the past decade. What Trump has done is inject American power into this political current.

Mehta draws a striking comparison: Trump’s worldview mirrors that of ancient Chinese emperors who saw China as the “Middle Kingdom”—the centre of the world to which others paid tribute. Under this logic, the U.S. is the indispensable core, while regions like Africa are relegated to the periphery.

The result, Mehta argues, has been a noticeable retreat from Africa. American aid systems have been dismantled, migration pathways restricted, and trade preferences left in limbo. For African leaders and businesses, this era signals not only indifference but active disengagement by Washington.

The Waning of Western Supremacy

Ironically, Trump’s geoeconomic gambits have not shored up American influence. Instead, they appear to be accelerating the decline of Western-led hegemony.

“What Trump and his crew are trying to do is reinforce American dominance and that of its ideological allies,” Mehta explained. “But in the Global South, the widespread perception is that this dominance is eroding faster than ever.”

Indeed, countries across Africa, Asia, and Latin America are reassessing their alliances. From China’s Belt and Road Initiative and Russia’s African outreach, to India’s Global South diplomacy and the strengthening of BRICS+, a multipolar order is taking shape—one where Washington no longer calls all the shots.

The Dollar Dilemma

A potent symbol of U.S. dominance has long been the petrodollar system, which links oil trade—and much of global commerce—to the U.S. dollar. But even that is being challenged.

Countries are increasingly stockpiling gold and moving away from U.S. Treasury bills. “The general sentiment is that the U.S. dollar does not seem a necessary currency,” Mehta observed. The change won’t be immediate, but it’s underway.

For Africa, this shift carries both risks and opportunities. On one hand, remittances—typically sent in dollars—could depreciate. On the other hand, African exporters are no longer confined to the dollar. They can transact in euros, yuan, yen, or even the South African rand. As Mehta puts it, “Trade was there before the dollar.”

Africa’s Path to Self-Reliance

So how is Africa responding to this new reality?

For years, African governments have discussed industrialisation, regional integration, and resilient supply chains. Initiatives like the African Continental Free Trade Area (AfCFTA) aim to reduce dependence on foreign markets by building a unified economic bloc. Meanwhile, South-South cooperation—from India’s pharmaceutical outreach to Brazil’s agricultural expertise—has opened fresh avenues for growth.

Yet structural challenges persist. The continent faces high debt, underdeveloped infrastructure, and chronic shortfalls in financing its Sustainable Development Goals (SDGs). The war in Ukraine has further complicated matters by diverting Western attention and aid toward European security.

According to Mehta, the Bretton Woods institutions—the World Bank and IMF—are no longer fit for purpose when it comes to financing the Global South. Reform is needed, but progress remains slow.

Four Crucial Turning Points

Mehta outlined four key issues that could determine Africa’s trajectory in the emerging geoeconomic landscape:

- BRICS as a Platform

Africa’s powerhouses—South Africa, Nigeria, and Egypt—are already integrated into or adjacent to BRICS. While some critics label the group as “anti-West,” Mehta disagrees. “BRICS is becoming the Global South’s premier platform,” he said. For African countries, deeper engagement offers both promise and diplomatic complexity, particularly for Western-aligned nations like Egypt.

- The Future of the Dollar

Though the U.S. dollar’s dominance may persist for decades, it is undeniably weakening. The rapid development of Central Bank Digital Currencies (CBDCs) and growing interoperability could revolutionise cross-border trade. Africa cannot afford to be a bystander in this digital transformation.

- Debt Relief – A “HIPC 2.0”

Africa’s debt burden has reemerged in new forms. Mehta advocates for a fresh Heavily Indebted Poor Countries (HIPC) initiative—a “HIPC 2.0.” This time, however, it must be Africa-led and tied to investment in human capital: education, healthcare, and workforce skills.

- Demographics as Destiny

Africa is the world’s youngest continent—and will remain so for decades. But youth alone is no guarantee of progress. “They don’t have purchasing power due to low human capital,” Mehta said. Linking debt relief to human capital development could unlock vast consumer markets, benefiting both Africa and its trading partners in the Global South.

Africa’s Moment in a Multipolar World

Trump’s geoeconomics may not have been designed with Africa in mind, but its effects on the continent are undeniable. By turning its back on Africa, Washington risks pushing it further into the arms of alternative partners.

African leaders, meanwhile, must navigate a complex geopolitical terrain: balancing rival powers, managing sovereign debt, and turning population growth into economic opportunity.

If there’s one enduring lesson from Trump’s foreign policy, it’s this: Africa can no longer count on the generosity of external powers. Its future lies in its own hands—by championing regional integration, deepening South-South alliances, pushing for global financial reform, and investing in its people.

As Mehta concludes, “The global economic architecture is changing, but Africa must claim its place in shaping it.”

*Kester Kenn Klomegah is a veteran journalist, policy researcher, and business consultant. His work focuses on international relations, geopolitics, and Africa’s economic development in the context of global power shifts. His writing regularly appears in leading international publications. [IDN-InDepthNews]

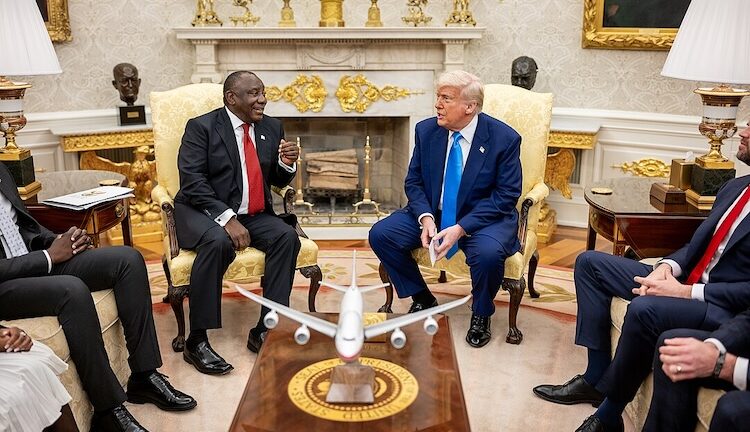

Image: U.S. President Donald Trump met with President of South Africa Cyril Ramaphosa, on 21 May 2025, in the Oval Office. White House Photo by Daniel Torok.